Unlock the power of statistical analysis with our in-depth exploration of credit scoring, utilizing real-world data from the German Credit Dataset. This comprehensive study delves into the intricate world of assessing creditworthiness. From meticulous data preprocessing, handling outliers, and class imbalance solutions to building a logistic regression model, we provide a step-by-step guide to elevate your credit scoring game. Discover how statistical analysis can transform the financial decision-making process, enabling institutions to make more informed, accurate, and efficient lending choices. Experience the future of credit scoring with our innovative insights.

Problem Description

In the realm of financial institutions, the practice of credit scoring plays a crucial role in assessing the creditworthiness of individuals and small businesses, particularly in the context of a statistical analysis assignment. Credit scoring is the statistical analysis used by lenders to determine whether they should extend credit to a person or a small business entity. This assessment has a profound impact on a wide range of financial transactions, including mortgages, auto loans, credit cards, and personal loans.

The challenge in this domain revolves around minimizing two critical errors: the false positive, which entails giving a high credit score to a candidate who may default on their credit, and the false negative, which involves assigning a low credit score to someone who is highly likely to repay their obligations. Such errors can be costly to financial institutions and can lead to significant financial losses due to intense competition in the industry.

To address this issue, various methods are employed, ranging from conventional statistical techniques like logistic regression to more advanced methodologies such as ensemble learning methods and deep learning models. The latter often yield superior results. However, the journey begins with one key ingredient: high-quality data, encompassing a candidate's social characteristics and their credit history.

This report is divided into three parts:

Problem Statement and Data Sources

Proposed Methodology

Analysis and Results

For our analysis, we utilize a dataset sourced from the UCL repository that contains information related to German credit data. This dataset, initially released in 1994 by Professor Dr. Hans Hofmann from the University of Hamburg, consists of 1000 observations and 20 variables.

To tackle the credit scoring problem, we opt to employ logistic regression—a classification technique. However, before delving into modeling, we undertake crucial preliminary steps:

A univariate and bivariate analysis to understand the data's characteristics.

Handling missing values and outliers.

Studying the correlations among variables.

Utilizing a confusion matrix to evaluate the model's quality.

What is logistic regression? Theory and assumptions

Logistic regression is an example of GLM (Generalised Linear Model) where logit is a link function. Logistic regression models predict the probability of binary outcome therefore they are commonly used to deal with classification problems.

In logistic regression probability that event will occur is measured in a specific way - it is based on calculation of odds ratio.

In statistics odds are defined as:

Odds=p(x)1-p(x)

p(x) - probability (p) that event (x) will occur,

1-p(x) - probability of failure.

In logistic regression logit is a link function. Logit is a logarithm of odds:

Logit=ln p(x)/(1-p(x) )

There are some underlying assumptions of logistic regression:

logistic regression requires linearity between independent variable and log-odds,

response variable must be dichotomous,

no strong correlation between independent variables,

Moreover, it is indicated that:

the dataset contains many observations with no outliers.

Our core focus in this section is to demonstrate the application of logistic regression for credit risk modeling using the German Credit Dataset. With a visualization of categorical and numeric data, we gain valuable insights into the dataset:

Categorical data visualizations highlight patterns such as the impact of checking account balances on credit repayment.

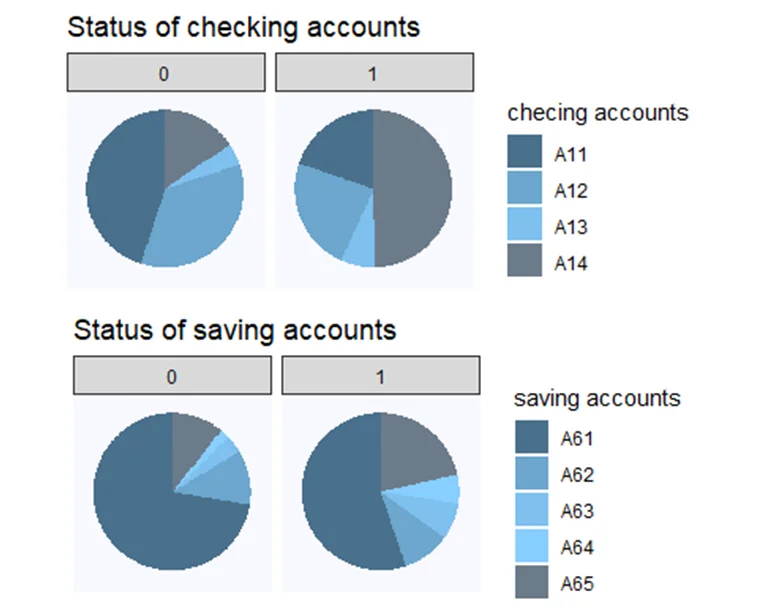

Fig 1:Categorical data visualization

Status of checking accounts:

The majority of clients classified as “good” have no checking accounts. It is an interesting remark - the intuition tells us that the higher balance of checking account is, the client is more likely to repay the loan on time. The description of the feature is rather vague so we can only speculate why the majority of “good” clients have no checking account.

We can also see that there are slight differences between two groups of clients who’s checking account balance is higher than zero. Respectively 16% and 11% of “good” and “bad” clients have 0-200 DM on their accounts. 5% of people paying back credits duly have more than 200 DM while within the group of “bad” clients there is only 1%.

Status of saving accounts:

Most of the clients classified as “good” have no saving account or the balance of their account is less than 100 DM. That observation is also surprising.

- Bivariate analysis explores differences between clients based on credit history, job, and other factors.

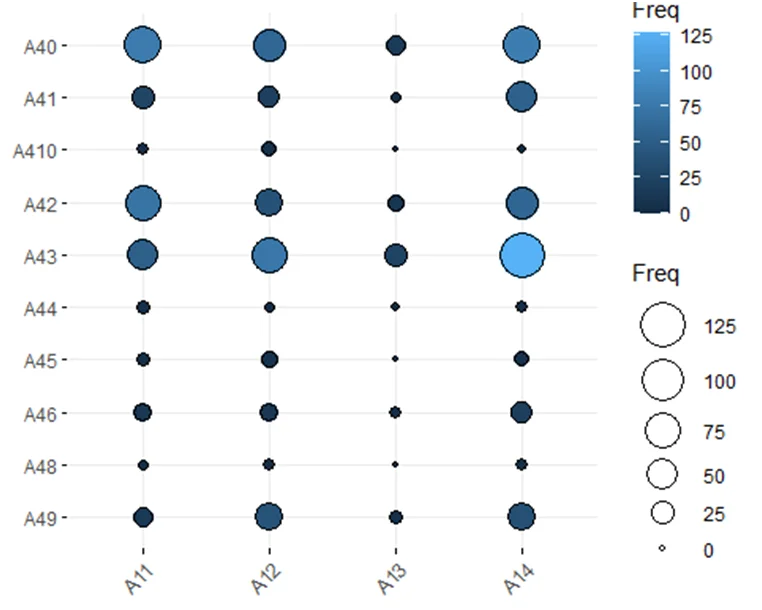

Fig 2: balloonplot from the ggplot package.

Purpose of loan and status of checking account

We can observe that there are no significant differences between clients grouped by the status of checking accounts. Customers mostly use their loans to buy the radio/television, car (new or used) or house equipment.

Loans are mostly for personal consumption (with given data). Therefore we can suppose that the median of the loan amount and the loan period in the given population should not be higher than respectively 3000 DM and 5 years. We can check this assumption by calculating some statistics.

Data Preprocessing:

- We check for missing values, finding none in our dataset.

The first step we should take in data preprocessing is to check whether there are any missing values in the dataset. To check if the German Credit dataset contains any missing values we will use the function “missmap” from the Amelia package.

checking_acc duration credit_history

0 0 0

purpose loan_amount saving_acc

0 0 0

employment_duration installment_in_income maritial_status

0 0 0

other_debtors residance properties

0 0 0

age other_installments housing_situation

0 0 0

existing_loans job maitaince

0 0 0

phone foregin_worker results

0 0 0

Dummy_results

0 - Outliers are detected and handled by replacing them with a mean ± 3 times the standard deviation.

- To address class imbalance, we oversample the data using the ROSE package.

over_data <-ovun.sample(Dummy_results ~ ., data = my_data, method ="over", N =1398)$data

tab3 <-as.data.frame(table(my_data$Dummy_results))

colnames(tab3) <-c("Class", "Freq berfore oversampling")

tab4 <-as.data.frame(table(over_data$Dummy_results))

colnames(tab4) <-c("Class", "Freq after oversampling")

tab5 <-as.data.frame(cbind(tab3$Class, tab3$`Freq berfore oversampling`, tab4$`Freq after oversampling`))

colnames(tab5) <-c("Class", "Freq berfore oversampling", "Freq after oversampling")

tab6 <- tab5 %>%

formattable()

tab6 Class

Freq berfore oversampling

Freq after oversampling

1

300

699

2

699

699

Splitting data into train and test

Now we can split the data into training and test

sample_data <-sample(nrow(over_data), 0.7*nrow(over_data))

train <- over_data[sample_data, ]

test <- over_data[-sample_data, ]

dim(train)

[1] 978 22

dim(test)

[1] 420 22 Correlation matrix

One of the assumptions of logistic regression is low correlation between independent variables. To check this assumption we will create the correlation matrix. To calculate correlation between variables of different types we can use a function “hetcor” from the polycor package.

train_corelation <-hetcor(train)

train_cor_table <-as.data.frame(train_corelation$correlations)

# install.packages('ggcorrplot') library(ggcorrplot)

cor_plot1 <-ggcorrplot(train_cor_table, colors =c("azure1", "azure2", "lightcyan4",

"cadetblue3")) +labs(title ="Correlation matrix")

cor_plot1

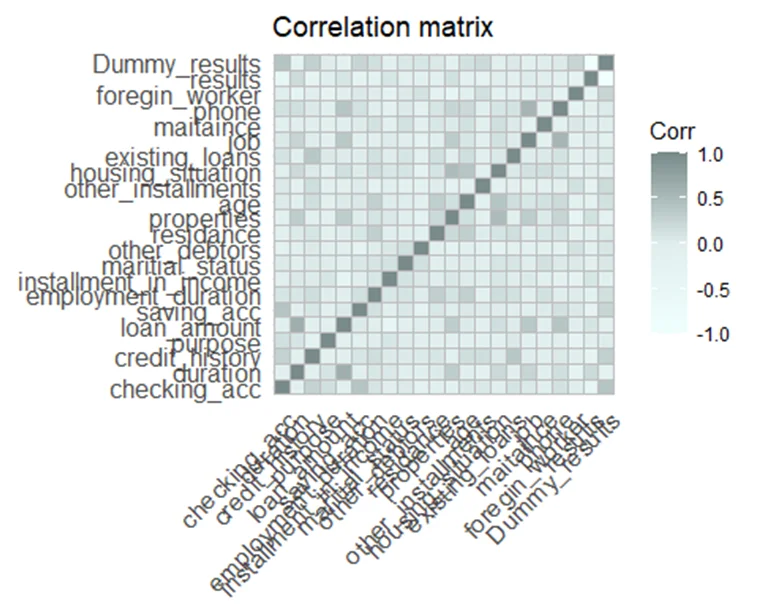

Fig 3: Correlation matrix

There is no strong correlation between any of variables from the German Credit Dataset.

Building the Logistic Regression Model:

- The logistic regression model is constructed using the glm() function, focusing on attributes like checking account status, saving account status, duration, age, and loan amount.

# Logistic regression model

model1 <-glm(formula = Dummy_results ~ checking_acc + saving_acc + duration + age +

loan_amount, data = train, family =binomial(link ="logit"))

summary(model1)

Call:

glm(formula = Dummy_results ~ checking_acc + saving_acc + duration +

age + loan_amount, family = binomial(link = "logit"), data = train)

Deviance Residuals:

Min 1Q Median 3Q Max

-2.2217 -0.9513 0.4521 0.9359 1.9605

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -8.288e-01 2.915e-01 -2.843 0.004472 **

checking_accA12 3.232e-01 1.835e-01 1.761 0.078181 .

checking_accA13 6.698e-01 2.867e-01 2.337 0.019453 *

checking_accA14 1.833e+00 1.933e-01 9.484 < 2e-16 ***

saving_accA62 -7.230e-02 2.318e-01 -0.312 0.755105

saving_accA63 6.679e-01 3.786e-01 1.764 0.077728 .

saving_accA64 6.331e-01 3.992e-01 1.586 0.112749

saving_accA65 6.828e-01 2.061e-01 3.312 0.000925 ***

duration -3.057e-02 7.437e-03 -4.110 3.96e-05 ***

age 2.010e-02 6.608e-03 3.041 0.002358 **

loan_amount 2.047e-06 3.282e-05 0.062 0.950254

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 1354.6 on 977 degrees of freedom

Residual deviance: 1140.4 on 967 degrees of freedom

AIC: 1162.4

Number of Fisher Scoring iterations: 4

summary_model1_table <-summary(model1)

model1_coeff <-as.data.frame(round(summary_model1_table$coefficients, 6))

# significance_function <- if()

is_significant_fun <-function(x) {

if (x >0.05) {

"not significant"

} else {

"significant"

}

}

model1_coeff$significance <-sapply(model1_coeff$`Pr(>|z|)`, is_significant_fun)

model1_coeff

Estimate Std. Error z value Pr(>|z|) significance

(Intercept) -0.828759 0.291528 -2.842814 0.004472 significant

checking_accA12 0.323159 0.183474 1.761337 0.078181 not significant

checking_accA13 0.669838 0.286655 2.336738 0.019453 significant

checking_accA14 1.833394 0.193319 9.483778 0.000000 significant

saving_accA62 -0.072304 0.231808 -0.311915 0.755105 not significant

saving_accA63 0.667908 0.378627 1.764025 0.077728 not significant

saving_accA64 0.633097 0.399189 1.585958 0.112749 not significant

saving_accA65 0.682757 0.206126 3.312332 0.000925 significant

duration -0.030566 0.007437 -4.109806 0.000040 significant

age 0.020095 0.006608 3.041042 0.002358 significant

loan_amount 0.000002 0.000033 0.062388 0.950254 not significant Interpreting the Coefficients:

- We interpret the coefficients of the model to understand how different features impact the probability of successful credit repayment.

For categorical variables we interpret the probability of success comparing the estimate of coefficient for particular level with the “reference level” (to set the reference level use the function relevel)

# Setting level for the feature checking account - I've set the reference level

# before building the model relevel(train$checking_acc, ref = 'less than 0 DM')

levels(train$checking_acc)

NULL

Example:

The reference level for the feature “status of checking account” is “less than 0 DM”. The positive value of estimates for the level “0-200 DM” (0.573706) means that a client having 0-200 DM on her/his checking account is more likely to pay back the loan on time compared to the client who has less than 0 DM on her/his account.

Output interpretation - AIC and null/residual deviance

AIC

AIC (Akaike information criterion) allows us to compare two models. Read more about AIC and BIC on Wikipedia: https://en.wikipedia.org/wiki/Akaike_information_criterion

The general rule is: choose the model with the lower value of AIC/BIC.

Null deviance/residual deviance

The lower the value of deviance is, the goodness of fit of the model is better. In glm() output for logistic regression null deviance shows how well fits the model which contains only the intercept. Residual deviance measures the goodness of fit for the model which includes all explanatory variables.

For the model we have built the value of the null deviance is 1354 whereas the value of residual deviance is 1139,7. It means that model containing explanatory variables could be characterized by better fitness than the model only with the intercept.

Model Validation: Confusion Matrix

Confusion matrix presents how many of predictions are: * true positive, * true negative, * false positive, * false negative.

Building the confusion matrix is a great method to check the accuracy of the model. In R language there is a dedicated function confusionMatrix() - however we can also build the confusion matrix with a function table(). We will compare the predictions of the built model with the test subset of data.

# Confusion matrix

predicted <-predict(model1, newdata = test, type ="response")

pred <-ifelse(predicted >0.5, 1, 0)

table(predicted = pred, actuals = test$Dummy_results)

actuals

predicted 0 1

0 175 74

1 52 119 Conclusions

In this study, we have successfully delved into the world of Credit Scoring using real-world data from the German Credit Dataset. By employing logistic regression, we have created a model that aids decision-makers in streamlining the credit assessment process, making it more efficient and less prone to human errors. The insights gained from this analysis can pave the way for future improvements, including the implementation of advanced techniques such as ensemble methods and deep learning models to further enhance credit scoring accuracy.

You Might Also Like

Explore our diverse sample collection for insightful assignments covering fundamental concepts to advanced methodologies. Dive into a wealth of topics and solutions tailored to your needs. Unlock valuable knowledge and inspiration through our curated samples.

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

R Programming

SAS

R Programming

R Programming

R Programming