Claim Your Offer

Unlock an exclusive deal at www.statisticsassignmenthelp.com with our Spring Semester Offer! Get 10% off on all statistics assignments and enjoy expert assistance at an affordable price. Our skilled team is here to provide top-quality solutions, ensuring you excel in your statistics assignments without breaking the bank. Use Offer Code: SPRINGSAH10 at checkout and grab this limited-time discount. Don’t miss the chance to save while securing the best help for your statistics assignments. Order now and make this semester a success!

We Accept

- Understanding Time Series Assignments

- Preparing the Data for Analysis

- Applying Autoregressive Distributed Lag (ARDL) Models

- Conducting Forecasting Analysis

- Evaluating Unit Roots and Cointegration

- Implementing Vector Autoregression (VAR) Models

- Addressing Model Selection and Interpretation

- Conclusion

Time series analysis is one of the most significant topics in econometrics, widely used for economic and financial forecasting. Students often face assignments that require analyzing historical data, identifying patterns, and making predictions using various econometric models. Such assignments usually involve methods like Autoregressive Distributed Lag (ARDL) models, Vector Autoregression (VAR), unit root tests, and cointegration analysis. Successfully solving these assignments requires a deep understanding of data handling, model selection, and statistical interpretation.

This blog provides a structured approach to handling such assignments, ensuring that students understand how to clean and analyze time-series data, build models, interpret results, and make forecasts. Whether you need to complete your Time Series Analysis Assignment or enhance your understanding of econometric techniques, we will closely follow the requirements of a typical time-series assignment, providing a step-by-step breakdown of critical econometric methods. The goal is to help students develop the skills necessary to complete such assignments accurately and efficiently.

Understanding Time Series Assignments

Time series analysis is a critical component of statistical modeling, particularly when working with economic, financial, and scientific data. It involves examining data points collected or recorded at specific time intervals to identify underlying patterns, trends, and seasonal effects. Assignments in this area often require students to analyze historical data, detect trends, and make accurate forecasts based on observed patterns. These tasks typically involve applying advanced econometric models such as Autoregressive Distributed Lag (ARDL), Vector Autoregression (VAR), and unit root tests to assess data stationarity and relationships between variables over time. A strong grasp of these methodologies is essential for interpreting results effectively and making informed predictions, as improper implementation can lead to misleading conclusions. Understanding how to apply these models using statistical software such as R, Python, or EViews can further enhance the accuracy and reliability of the analysis.

Preparing the Data for Analysis

Before any econometric modeling, data preparation is crucial. This includes:

- Importing Data into Statistical Software: Most time series assignments require using software like Stata. The first step involves loading the dataset and ensuring the date variable is correctly formatted.

- Declaring Time-Series Data: Properly specifying the dataset as time-series ensures that all functions related to time lags, differencing, and forecasting work correctly.

- Visualizing the Data: Plotting variables in levels and differences provides insights into stationarity and potential relationships.

Applying Autoregressive Distributed Lag (ARDL) Models

ARDL models are useful for examining relationships between variables over time. When solving an assignment involving ARDL models:

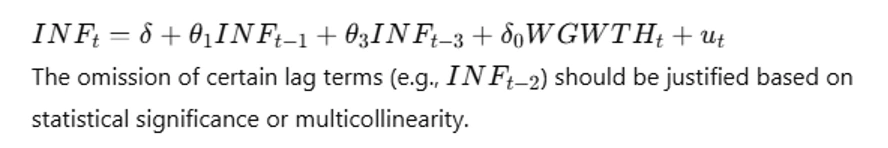

- Estimate a Basic ARDL Model: The simplest specification might involve an equation such as:

- Test for Serial Correlation: Use tests like the Breusch-Godfrey LM test to check for autocorrelation in the residuals. If serial correlation is detected, alternative specifications with additional lags should be considered.

- Selecting the Optimal ARDL Model: Using criteria like Akaike Information Criterion (AIC) or Schwarz Bayesian Criterion (SBC) helps in choosing the best model.

This model helps determine the short-term and long-term impact of wage growth on inflation.

Conducting Forecasting Analysis

Assignments often require forecasting future values using estimated models. Key steps include:

- Selecting an Appropriate Forecasting Model: Common specifications include:

- Generating Forecasts: Plugging in given future values of predictor variables (e.g., wage growth rates) into the estimated equation allows computation of expected inflation.

- Constructing Confidence Intervals: Forecast intervals are calculated using the Root Mean Square Error (RMSE) to provide a range within which future values are expected to fall.

Evaluating Unit Roots and Cointegration

Determining whether time-series variables are stationary is crucial:

- Conducting Unit Root Tests: The Dickey-Fuller and Augmented Dickey-Fuller (ADF) tests assess whether variables have unit roots, with hypotheses:

- Null Hypothesis: The series has a unit root (non-stationary).

- Alternative Hypothesis: The series is stationary.

- Checking for Cointegration: If two non-stationary variables share a long-term relationship, they may be cointegrated. The Engle-Granger test is commonly used to determine cointegration between variables like price indices.

Implementing Vector Autoregression (VAR) Models

VAR models are powerful for analyzing interdependencies between multiple time-series variables. When tackling a VAR-based assignment:

- Estimate Different VAR Specifications: Models with varying lag lengths should be tested to determine the best fit.

- Performing Granger Causality Tests: These tests evaluate whether past values of one variable help predict another.

- Generating Impulse Response Functions (IRFs): IRFs visualize how shocks to one variable affect others over time.

Addressing Model Selection and Interpretation

- Comparing ARDL and VAR Models: Depending on the problem statement, students must determine whether a single-equation model like ARDL or a multi-equation model like VAR is more appropriate.

- Interpreting Multipliers in ARDL Models: The impact multiplier shows the immediate effect of a change in an independent variable, while the total multiplier indicates the long-term effect.

- Evaluating Forecasting Accuracy: Models should be tested for goodness-of-fit using RMSE, Mean Absolute Error (MAE), and Mean Squared Error (MSE).

Conclusion

Time series assignments require a well-structured and methodical approach, covering every stage from data preparation to model estimation and result interpretation. A strong grasp of econometric principles, including ARDL, VAR, and unit root tests, is essential for successfully completing such assignments. Students must pay close attention to proper model selection, thorough diagnostic testing, and a clear, well-organized presentation of their findings.

By following these steps, students can confidently tackle time series assignments while ensuring accuracy, clarity, and logical coherence in their analyses. The ability to interpret complex economic relationships, conduct reliable forecasting, and derive meaningful insights will not only contribute to academic excellence but also prove invaluable in real-world economic analysis and strategic decision-making. If you want to enhance your skills and solve your Statistics Assignment effectively, practicing time series analysis regularly will be highly beneficial. With persistence and dedication, mastering time series assignments becomes an achievable goal, empowering students with robust analytical abilities that are essential for success in both academic and professional fields.